2082

E-Filed Returns

145

Paper Filed Returns

245

ITIN Filers

2225

Total Tax Filed

$3.8M

In Federal & State Tax Returns in 2023

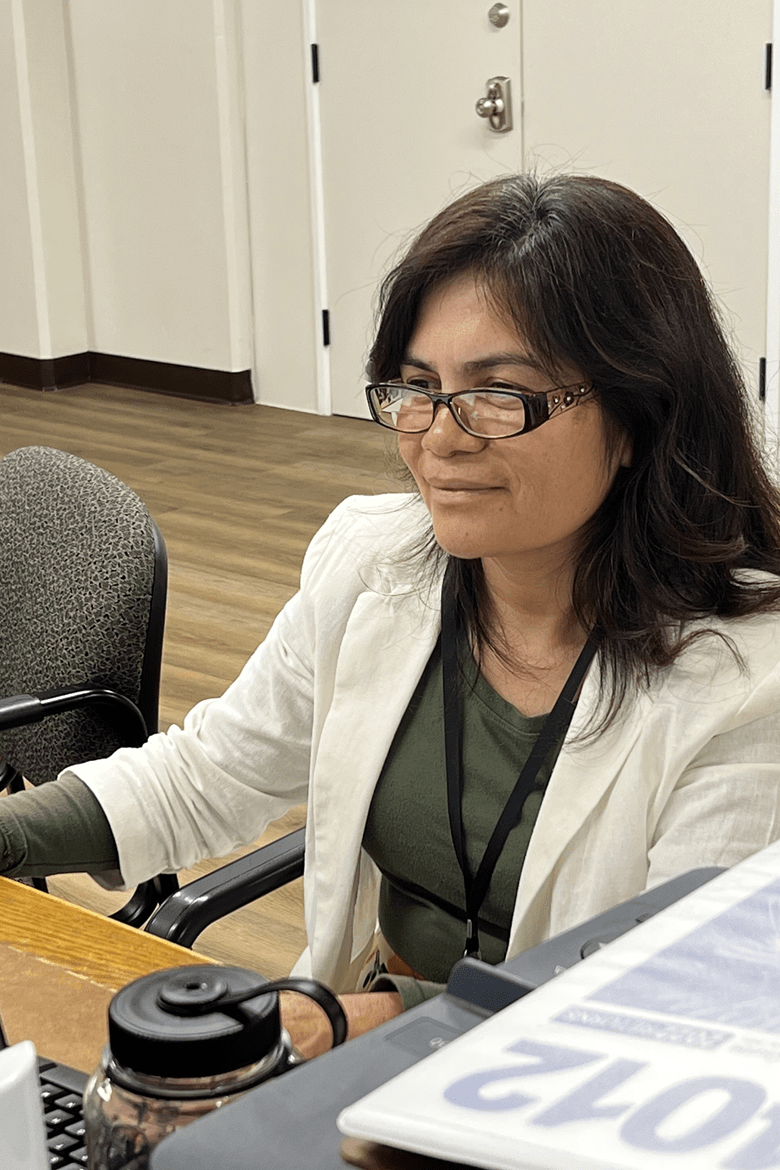

⸻ VITA

VOLUNTEER INCOME TAX ASSISTANCE

United Way of Central Eastern California has run many resourceful programs throughout the years in order to help the community. One of them being the VITA (Volunteer Income Tax Assistance) program. This program falls under the United Way of Central Eastern California financial stability department which is a free income tax assistance program that has granted low-income families and single individuals the option of not having to pay for such an expensive service, while still receiving quality work.

Thanks to the help of multiple local partners and our amazingly dedicated volunteers we have been able to not only provide this free service but also bring money, that is much needed, back into our community. During the 2021 tax year, we were able to file over 1,600 tax returns and bring back right under 2.7 million dollars in tax refunds to the community! Our goal is to keep these numbers growing, but in order to do that, we need the help of volunteers.

By becoming a VITA volunteer, not only will you learn about tax laws, but you will develop and discover new skills, meet new people and even make great connections within the kern community. If you are someone looking for a volunteer opportunity where you want to make a change, come out and join us and become a part of the amazing VITA team.

⸻ Requirements

What Do I Bring?

· Government issued ID (Driver’s license, passport, picture ID card)

· Social Security Cards or ITIN numbers for every member claimed

· All sources of income (W-2’s, 1099’s, Unemployment, SSI, Retirement, other income, etc.)

· If self-employed: total records of income and expenses

· Proof of medical insurance (1095-A is required)

· Any Educational Expenses for college students only (1098-T, 1098-E)

· Child Care Expenses (Wages paid, tax ID, address)

· Bank account information for Direct Deposit Refunds (Routing and Account Number)

· Previous year tax return

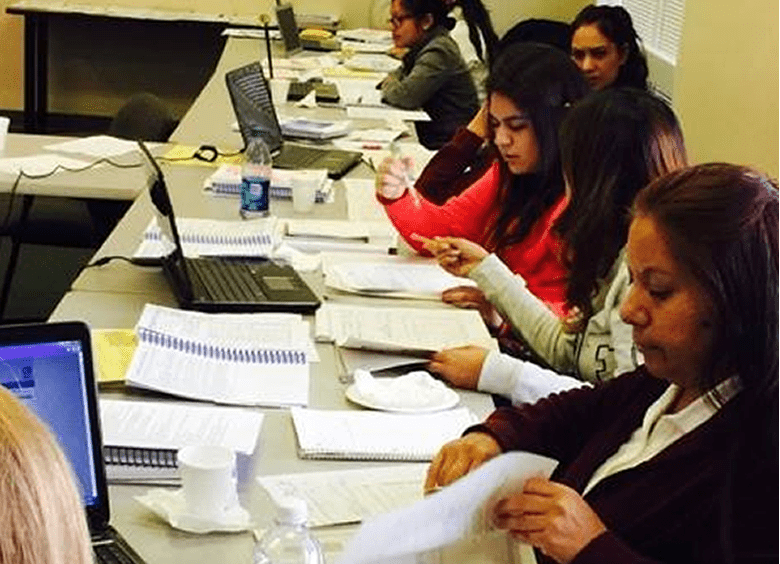

⸻ Volunteer

HOW DO I VOLUNTEER?

Volunteers are needed to serve as tax preparers, greeters, and translators for the 2022 tax season. No experience is necessary and FREE training will be provided. Training begins in November. To get more information or register to volunteer please contact Gabriel at sofia.m@uwkern.org or call (661) 834-2775.